With most of this year’s empty homes tax declarations now submitted, Vancouver’s mayor says the tax is continuing to work as intended.

Homeowners had until Tuesday to declare whether their homes were occupied for a majority of the year, or else face the additional one-per cent tax on the property’s value.

Based on an initial review of declarations, the city says 787 properties were declared vacant for 2019 — down nearly 15 per cent from the number of vacant properties declared at the same point in 2018, which saw 922 vacancies.

The latest number is also 30 per cent down from the 1,131 vacant properties declared in 2017, when the empty homes tax was first introduced.

“The empty homes tax is working,” Mayor Kennedy Stewart said in a statement Friday.

“Our second set of year-over-year data clearly shows we’re returning more empty homes to the rental market.”

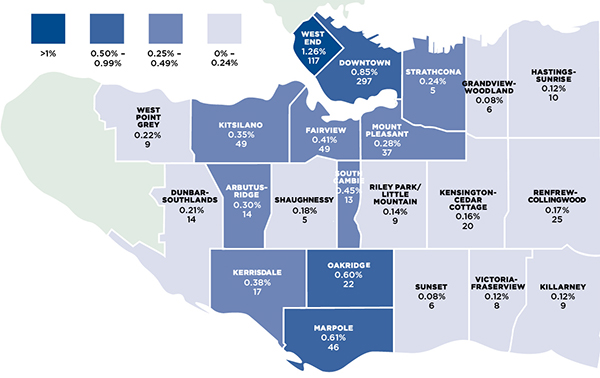

The city says the distribution of vacant properties throughout the city remains similar to 2018, with the largest concentrations found in the West End (117 properties, or 1.26 per cent of the total homes in the area), downtown (297, or 0.85 per cent), Marpole (46, or 0.61 per cent) and Oakridge (22, or 0.6 per cent).

According to the city, the total number of residential properties in the city overall — whether occupied or not — has gone up by 1.6 per cent year over year. The city says that’s mostly attributable to a three-per cent increase in the number of condominium units across Vancouver.

Thomas Davidoff, an associate professor at the Sauder School of Business at the University of British Columbia, agreed with Stewart that the tax is doing what it should: ensuring homes aren’t sitting empty and unused.

“It’s hard to see what the bad news would be with the tax in terms of the housing market,” he said, while admitting the potential for fraudulent returns could be skewing the numbers until audits are performed later in the year.

- Jim Robson, legendary voice of the Vancouver Canucks, dies at 91

- More than 100 B.C. First Nations urge Eby to uphold DRIPA or risk backslide

- Trial starts for man charged in connection with fatal stabbing outside Vancouver Starbucks

- Deaths of Prince Rupert family ruled homicide-suicide, inquest finds

“Very likely, a lot of it is people choosing to sell their units or to rent them out, rather than pay the empty homes tax,” he said.

Davidoff also pointed to a recent report from the Canada Mortgage and Housing Corporation that found an “unprecedented shift” in condo investors renting their units out to long-term tenants.

Get breaking National news

According to the report, the number of condos being rented out in the City of Vancouver by October 2019 jumped by 5,920 units from the same time in 2018 — a 21-per cent gain.

The city says revenue collected from the empty homes tax goes towards affordable rental projects throughout Vancouver, as well as modular housing programs that help address the city’s ongoing homeless crisis.

Last year, the city collected $39.4 million in revenue from the tax, which generated $38 million the year prior.

This year will be the final one where owners of vacant properties pay a one-per cent tax rate. The rate will jump to 1.25 per cent for the 2020 tax year.

“Homes are for people, not speculation, and I hope this higher penalty will provide even more of an incentive for owners of empty properties to make sure they are occupied,” Stewart said.

Stewart campaigned on the promise to raise the tax rate to three per cent, but a recent staff report said significant increases could lead to tax evasion and fraud.

Comments

Want to discuss? Please read our Commenting Policy first.