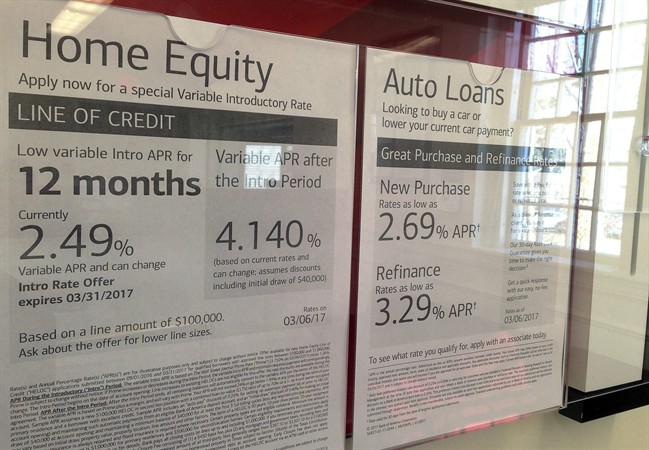

Canadians continue to borrow against the value of their houses at the fastest pace in more than five years, using home equity lines of credit, known as HELOCs.

Balances jumped another 7.2 per cent in December from a year earlier, the fastest pace since 2012. It reached a record $230 billion, whereas all other loans climbed only 3.2 per cent.

A report by Bloomberg Intelligence shows borrowers are using the value of their homes to borrow up to 65 per cent of the value for such things as renovations, investing, consolidating debt, or to spend on personal reasons. The report says that the borrowing is either greed or need-based.

Get breaking National news

The Bank of Canada is particularly worried as HELOC’s do not usually have a fixed repayment schedule compared to other loan types such as credit cards. But with HELOC rates being cheaper, as interest rates increase, so does the debt.

- WestJet execs tried cramped seats on flight weeks before viral video sparked backlash

- Pizza wars? As U.S. chains fight for consumers, how things slice up here

- Health Canada says fake Viagra, Cialis likely sold in multiple Ontario cities

- Canada increased imports from the U.S. in October, StatCan says

Comments