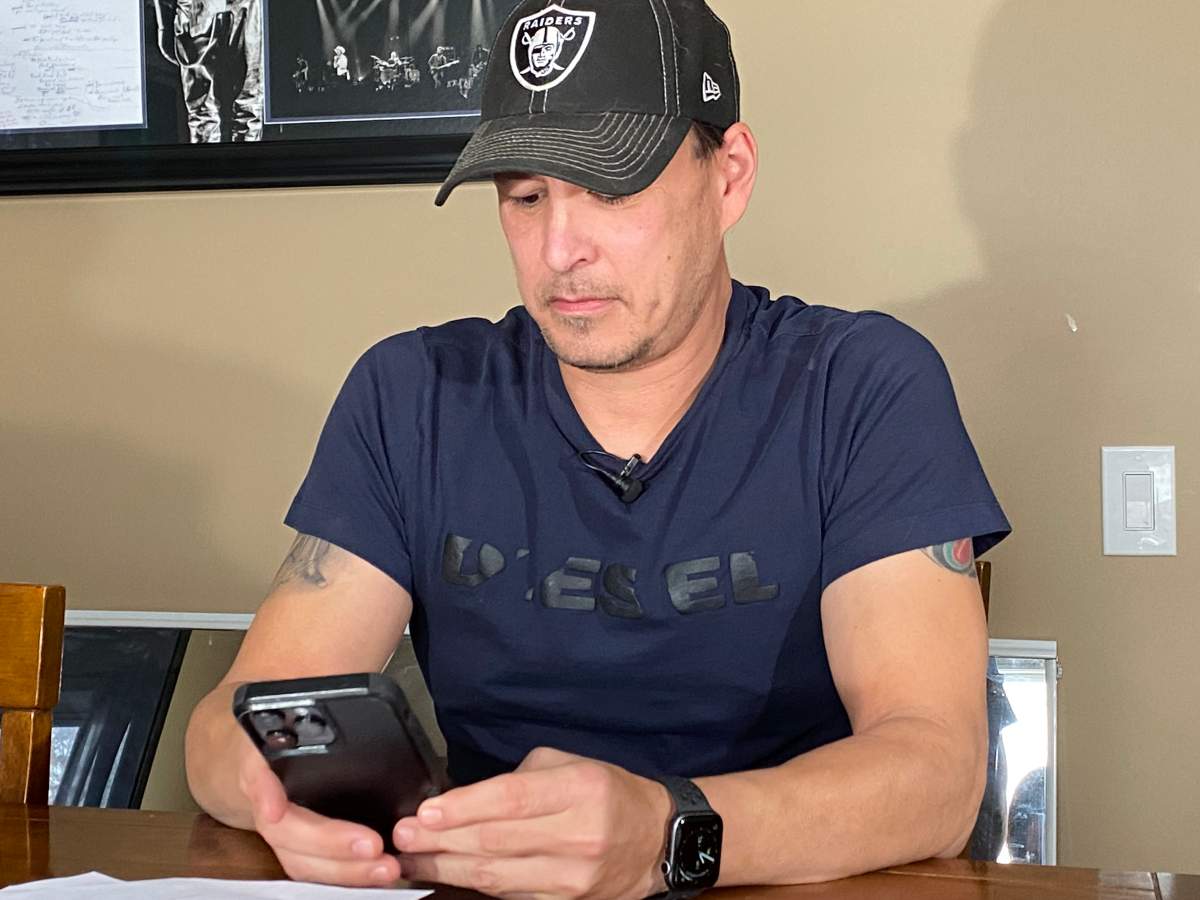

An Alberta man is calling on Telus to give him back his good credit rating following months of billing issues.

Calgarian Sean Pedersen told Global News the telecommunications giant first contacted him back in the summer, advising him he’d missed a bill payment. Two more notices followed, one of them advising his time to repay was up.

“I got a third statement saying, ‘You need to pay otherwise we’re going to send you to collections,'” he said.

Pedersen said that he had been paying his bills. He sent both Telus and the collections company proof of those payments, but despite numerous calls to both, he said he didn’t get anywhere.

“I phoned them at least 20 times. They keep giving me, ’90 days (for an investigation),'” he said. “I don’t know how they can get away with it. I’ve been dealing with it for almost six months.”

Pedersen said he believes the mix-up started when he went to a Calgary Telus retail location to switch cellphone providers. He said the switch somehow ended up resulting in him having three separate accounts. He said he paid into the one he thought was the “right one.”

“I just paid the second account number that they gave me. I didn’t know what else to do,” he said.

“That’s what I paid and apparently they can’t find their money.”

Pedersen said the collections agency was able to find one of the three “missing” payments, but not the rest. That, he said, has resulted in his credit score taking a huge hit.

“There’s four black strikes against my credit,” he added.

It hit the small business owner hard.

Get weekly money news

Pedersen runs STP Heating & Air Conditioning and was hoping to get a government loan to help out with expenses, but said the bank told him his low credit score means he no longer qualifies.

And his troubles don’t end there.

“I’m also worried about my mortgage renewal, because the bank said with my credit score being that low, ‘We don’t know if we would touch you.'”

Telus responds

Global News reached out to Telus to find out what is happening with Pedersen’s investigation.

In a statement, a spokesperson told Global News: “Our investigation recently uncovered that Mr. Pedersen may have accidentally entered an incorrect account number when making payments.”

“Despite Mr. Pedersen not providing proof of payment to this incorrect account, we are giving him the benefit of the doubt as an act of goodwill and are waiving his remaining account balance to resolve this issue.”

Pedersen told Global News that is not enough, adding he paid his bill and more.

“I’ve actually overpaid them,” he pointed out. “They actually owe me about $36.”

He also questioned what would happen to his credit score and whether it would be fixed. Global News asked Telus that, but did not get a clear answer at the time of publication deadline.

Credit scores

MNP Debt, a licensed insolvency trustee firm, told Global News Canadian consumers have some recourse when it comes to collections companies.

“There are protections,” Donna Carson said. “There are laws in each province.”

Carson said there are also ways to get your credit score back when and if a mistake has been made.

“If this is the only thing that’s gone to collection and has been paid, we can then guide you to where you can go to get that fixed.”

Carson said, generally speaking, people need to be proactive when it comes to their credit scores.

“Whether something has gone to collection or not, everybody should be checking their credit report periodically,” she added. “When there is something showing up on a collection report, if you’ve been proactive and obtained a copy of your report, you can dispute it.”

Carson said while it’s often easy to blame a credit rating company or collection agency, they’re only doing what they’re paid to do.

“The credit reporting agencies — they’re not the government,” she said. “They put on there what they are given, so it’s important to review what’s on there.”

Pedersen said he hoped what’s on his will soon be gone.

Comments

Want to discuss? Please read our Commenting Policy first.