When a federal finance minister makes a stop in Vancouver, he’ll inevitably face questions about the city’s punishing home prices.

And that’s precisely what happened when Bill Morneau stopped in for a chat with Global BC anchor Sophie Lui, to talk about issues such as housing affordability.

Coverage of Bill Morneau on Globalnews.ca:

Lui asked Morneau what the federal government is doing to address the affordability crisis that is hitting families across B.C.

RBC’s most recent Housing Affordability Report showed that, in Vancouer, servicing the mortgage for an average-priced condo would take up over 46 per cent of one’s income, while in Victoria, it would take up 37 per cent of local incomes.

The Canada Mortgage and Housing Corporation (CMHC) considers shelter “affordable” when it takes up less than 30 per cent of pre-tax household income.

READ MORE: Vancouver approved a condo project, in part, because it had rentals. They cost $5,400 per month

“What we’ve done… is we’ve put some things in place that are impacting the price increase,” Morneau said.

Get breaking National news

They included a requirement that people report the sales of their principal residences, and that they had to live in them every year they own them, in order to avoid paying a tax — this, he said, “reduced the amount of flipping and speculation.”

But Morneau also cited mortgage “stress tests” that the federal government put in place in 2016, that required borrowers to prove that they could make their payments in the event of an interest rate hike.

“We put in place some stress tests around mortgages so that we enable people to make sure that they’re getting the appropriate level of mortgage, which we know has a dampening effect on prices,” he said.

But there’s some question as to how much those “stress tests” affected home prices.

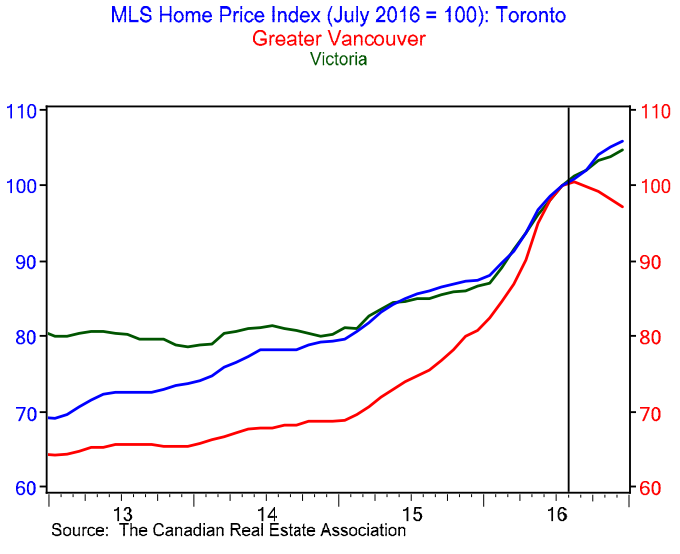

In January, BMO economist Douglas Porter issued a chart showing that prices dropped in Vancouver after the provincial government brought in a 15 per cent Property Transfer Tax on foreign buyers.

At the time, no such tax had been implemented in Toronto or Victoria, but the mortgage stress tests had. And yet prices kept climbing in both those areas.

Morneau also mentioned that the Office of the Superintendent of Financial Institutions (OSFI) would introduce a new minimum qualifying rate for mortgages that would take effect in January.

“We want to be careful we don’t want to impact the overall economy in a negative way but we want to get at the issues that are going to make a difference,” he said.

Lui challenged Morneau on this measure, asking whether it would make it more difficult for first-time homebuyers to enter the market. She also noted that prices are still going up.

“Well they are, but we of course, you can’t know what would happen if we weren’t doing these things which might make it even worse,” Morneau responded.

He said any measures that the federal government implemented would “apply across the whole country and the whole country’s not in the same position.”

“We have to think about the Vancouver market and the Kelowna market but we also need to think about the Halifax market and the, you know, the Timmins market,” Morneau said.

There is some evidence that the Liberals’ mortgage rules have moderated the growth of household debt.

A September report by RBC Economics showed that the introduction of mortgage qualifying standards “had a minimal dampening effect on mortgage loan growth.”

Nevertheless, residential mortgage growth did pick up in the first half of 2017 after it slowed last year.

A drop in national home sales in the second quarter did not, as of September, have a “material slowing impact on mortgage demand.”

Comments

Want to discuss? Please read our Commenting Policy first.