Cash is king over credit when it comes to buying cannabis for some Canadians.

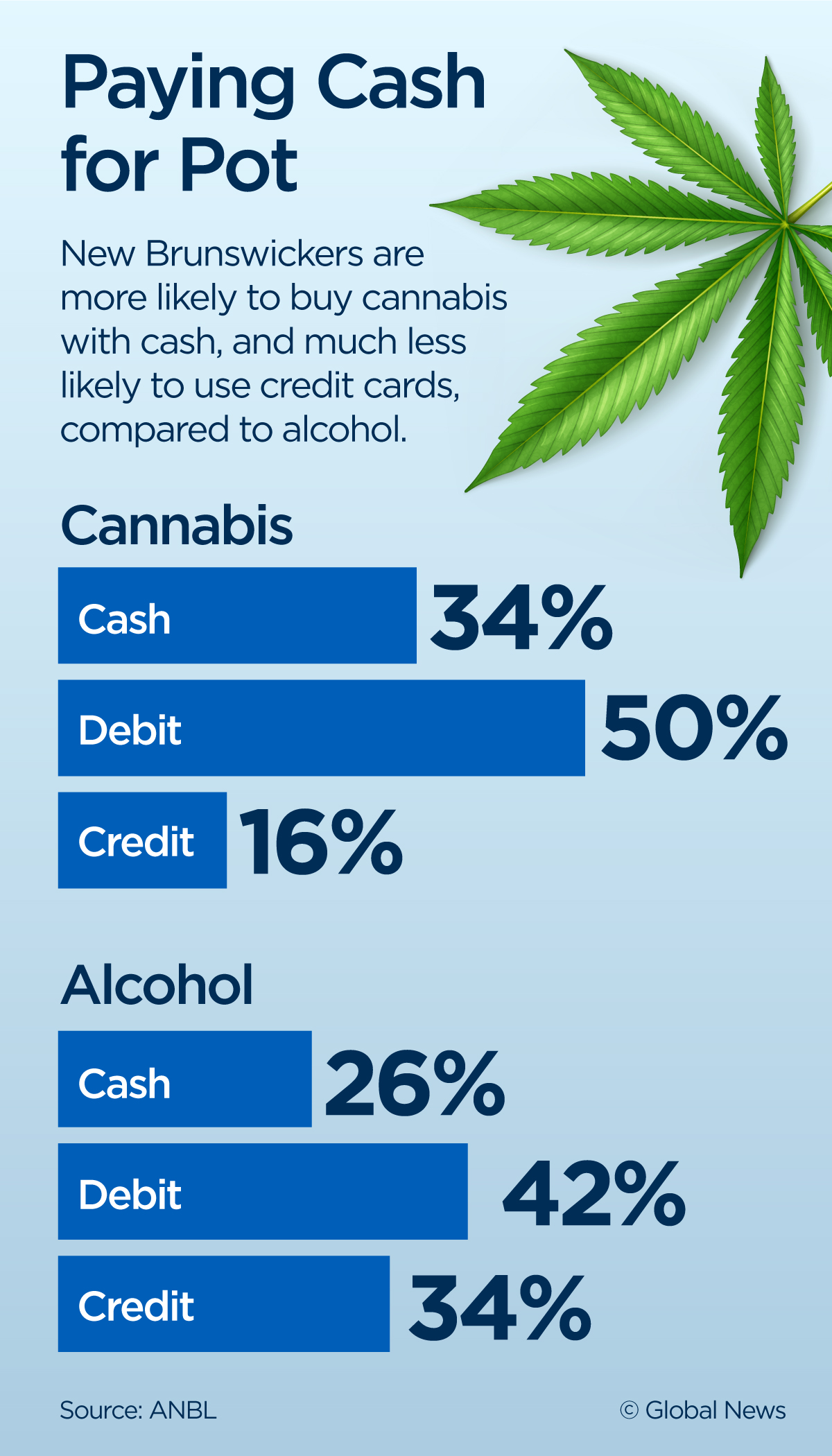

Latest data from bricks-and-mortar stores sales in New Brunswick show that cannabis buyers there are less than half as likely to use credit cards to buy cannabis, compared to alcohol. They are more likely to use cash or a debit card to purchase their pot.

The data covers sales at bricks-and-mortar stores only.

“The obvious possibility is that people want the anonymity,” says Brock University business professor Michael Armstrong. “Cash means there’s no transaction record.”

“With a debit card, presumably the transaction record is with your bank but not with a multinational credit card company.”

Since before legalization, there has been sensitivity about Canadians’ credit card cannabis purchases. Credit card records are held on servers in the United States, where U.S. officials can access their data without a warrant.

U.S. federal law bans “abusers” of drugs banned in the United States, including marijuana, from entering the country. “Abuse” refers to any level of use.

Whatever the law might say, however, there is no known case of a Canadian being banned from the U.S. for cannabis use in Canada after legalization.

The two known cases of recent cannabis-related bans affected a B.C. man who admitted he was going to look at a growing facility in Nevada run by a company he’d invested in, and Bev Camp, a 73-year-old man from London, Ont., whose 1976 conviction for possession of marijuana came up on a border official’s computer.

Canadians have a strong preference for buying weed in person in stores, rather than online. Provinces like Ontario, that until recently offered only online sales, sell very little cannabis per capita compared to provinces with more stores. One reason that’s often cited is that at a store, a customer can avoid using a credit card.

In December, the federal privacy commissioner recommended that Canadians use cash to buy cannabis if possible, warning that “some countries may deny entry to individuals if they know they have purchased cannabis, even lawfully.”

New Brunswickers seem quite happy to pay for pot with debit cards, which seems to mean that they’re concerned about credit cards specifically, not digital privacy in general.

Armstrong interprets that as the main concern being able to enter the U.S., not privacy in relation to disapproving family members or the rest of the community.

“An explanation for that is that people want more anonymity with respect to the border,” he says.

“If someone was just concerned about electronic records in general, you’d think that debit card use would also go down, but in fact, it went up, relative to alcohol.”

The effect is even stronger in New Brunswick communities very close to the border with Maine.

At the Saint Stephen Cannabis NB store, only 13 per cent of purchases are with credit cards. At the Perth store, it’s 11 per cent, and 12 per cent at the Edmunston store.

“Electronic privacy ought to have been an issue for all kinds of purchases, all kinds of behaviours,” Armstrong says. “People put all kinds of information on Facebook and such. All of a sudden, cannabis, because it’s a new issue, has led people to think about electronic privacy.”

“It’s interesting that it comes up in this context, whereas in other contexts people would be rather cavalier about it.”

Comments