One night in April 2016, RCMP officers were trailing a man driving west from Montreal to Toronto in a grey Hyundai Genesis, according to affidavits filed by the RCMP.

The vehicle would not have appeared suspicious to other drivers on Highway 401. But according to a senior RCMP officer, police had watched the driver — a wealthy North York currency exchange owner named Farzam Mehdizadeh — travel the onerous route from Toronto to Montreal and back, 81 times in a single year.

At 10:20 p.m., as Mehdizadeh drove past the village of Trenton, RCMP contacted an Ontario Provincial Police unit and asked them to pull Mehdizadeh over for speeding.

WATCH: Most provinces in Canada fail to secure convictions in money-laundering cases

An officer conducted a brief search of the Hyundai Genesis and found a bit of cannabis slipped into a cigarette package, RCMP officer Colleen Piers wrote in an affidavit obtained by Global News.

“It is at this time that Mehdizadeh voluntarily discloses that he has a large sum of money in his possession and that the money is in the amount of $1.3 million,” Piers said in her report describing the investigation.

READ MORE: RCMP says dismantled network in Toronto and Montreal laundered tens of millions

On the floor mat near Mehdizadeh’s feet — where the typical Highway 401 traveller might leave a Tim Hortons bagel wrapper — was a large brick of bundled $20s, according to a police report.

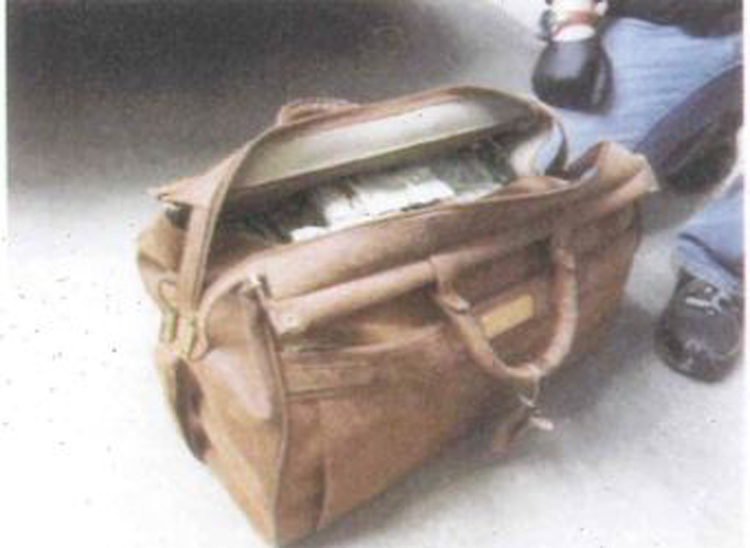

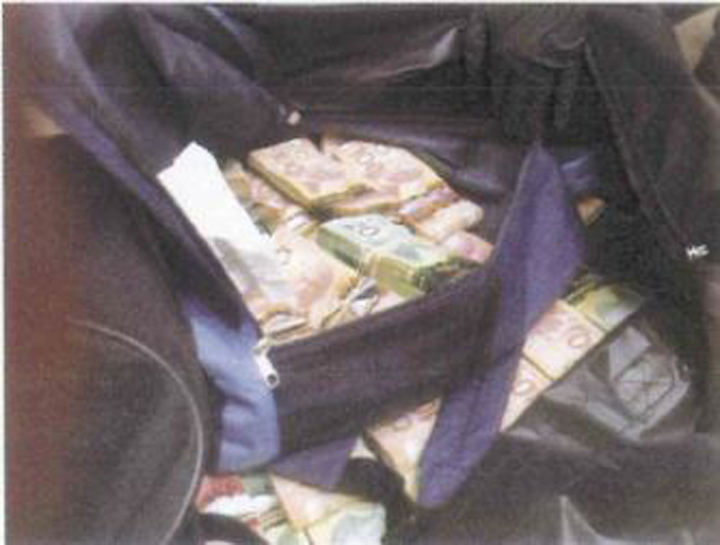

The officer opened Mehdizadeh’s trunk and saw a black hockey bag. It allegedly concealed 50 bricks of cash and a blue backpack that held another 21 bricks of cash. Pictures filed in RCMP evidence showed there was also a leather travel bag holding 37 bricks of cash, and the ID of a man with the last name of Pelletier.

Police seized Mehdizadeh’s car and the cash, and several days later, executed search warrants at Mehdizadeh’s Yonge Street currency exchange shop and his $4.8-million York Mills mansion.

The evidence they seized would allegedly reveal a global underground banking network — apparently legitimate accounting books and a second set of secret accounting books — plus wire transfers, bank drafts, and loans involving both major Canadian banks and also some shady currency trading shops.

And among the items seized from Mehdizadeh’s office — according to an RCMP evidence affidavit — were nine Ontario driver’s licences, and a brick of $20s wrapped in elastic bands and attached to a white bank envelope, with a $14,000 bank draft from a major Canadian bank tucked inside.

Eventually, Mehdizadeh would be accused of laundering $100 million in just one year in Toronto and Montreal and would be facing 16 criminal charges, including laundering drug money, tax evasion, and possessing proceeds of crime. Mehdizadeh has not responded to the charges and could not be reached for comment by Global News. His colleagues said they could not locate him either.

WATCH: Money laundering flowing through back-door channels in B.C. casinos

But the RCMP believed he was just one suspect in a very large group of underground bankers, active in Toronto and Montreal especially, with links to real-estate money laundering. And they were believed to be connected to the upper echelons of Middle East organized crime and terrorism financing, according to a senior former DEA investigator interviewed by Global News.

Since charges were laid in 2017, however, Mehdizadeh has yet to appear in court, and according to colleagues, he has left Canada for his native Iran. The RCMP would not confirm any information about Mehdizadeh’s current whereabouts.

A senior investigator with the United States Drug Enforcement Administration (DEA), who asked not to be identified because of potential ongoing investigations, added his voice to other critics from the DEA, that say this is just the latest example that Canada’s justice system is unable to tackle money laundering and transnational crime.

WATCH: Whistleblowers allege B.C. casinos knew about money laundering

A Global News investigation has found that Canada largely fails to effectively prosecute money-laundering cases, with just 321 convictions between 2000-2016. Roughly 809 cases were either stayed, withdrawn or dismissed, over that same time period, resulting in a conviction rate of around 27 per cent.

In B.C., just 10 people have been found guilty of money laundering since 2002, while Ontario has seen just 186 guilty verdicts since 2006.

Khanani network

Global News has learned that RCMP’s investigation and arrest of Mehdizadeh was the Canadian culmination of a number of global undercover investigations started by the DEA, and winding through Medellin, Colombia, to Dubai, Australia, Panama, Vancouver, Toronto and Montreal.

Mehdizadeh was arrested in an operation code-named “Project Oryx” RCMP affidavits say.

The evidence seized would connect Mehdizadeh to Altaf Khanani — an alleged mastermind underground banker and money launderer who moved up to $16 billion per year for global crime groups, with alleged links to Hezbollah and other terrorist groups that are now blurring into transnational organized crime networks, according to the DEA.

The U.S. Department of State has designated Khanani’s organization a “transnational organized crime group” with alleged links to “terrorist financing.”

“The Khanani money laundering organization also has been involved in the movement of funds for the Taliban, and Altaf Khanani, the group’s leader, is known to have had relationships with Lashkar-e-Tayyiba, Dawood Ibrahim, al-Qaeda, and Jaish-e-Mohammed,” a Department of State document alleges.

Khanani has not been charged specifically for terrorist financing, or for money laundering for terrorists, according to public records on his case.

Wall Street Exchange — one of the currency exchanges used by Khanani’s organization, according to a report that quotes a senior Australia Federal Police official — was also used to make a wire transfer through a Canadian bank and into the United States for the 9/11 terror strike, a congressional investigation found.

On Feb. 11, 2019, RCMP announced 17 people were charged after a series of raids were carried out in Montreal and Toronto targeting what investigators believe is an extensive international money-laundering syndicate with ties to organized crime.

The RCMP probe, dubbed Project Collector, involved 300 RCMP officers in Ontario and Quebec who carried out almost a dozen search warrants in Montreal and Toronto. The network, and time frame of the investigation, suggest possible connections to the international probe of Khanani and Project Oryx.

However, the RCMP would not comment on potential links suspected by a former DEA investigator interviewed by Global News.

Seventeen people face charges including conspiracy, possession of drugs for the purpose of trafficking, and laundering proceeds of crime. The network’s alleged leaders, Nader Gramian-Nik, 56, of Vaughan, Ont., and Mohamad Jaber, 51, of Laval, Que., were among those arrested.

Three suspects — Francisco Javier Jiminez Guerrero, 35, Victor Vargotskii, 56, and Frederick Rayman, 77 — are still being sought.

WATCH: B.C. Attorney General David Eby says ‘huge interest’ exists for money laundering public inquiry

“The network’s members facilitated the collection of money from criminal groups in Montréal and then laundered the results of their illegal business,” the RCMP stated. “The network moved money that was collected in Montréal through various individuals and currency exchange offices in Toronto.”

The RCMP alleged the underground banking network used what is known as hawala — meaning transfer of credit and debt among linked illegal bankers, without money actually crossing borders — with “connections in Lebanon, the United Arab Emirates, Iran, the United States and China. The funds were often wired through Dubai, and then returned to drug-exporting countries, such as Colombia and Mexico.”

The method of transaction is similar to the one RCMP say they exposed in B.C. casino money-laundering investigations.

To complete a transaction, a drug trafficker will arrange for $200,000 in drug cash, for example, to be deposited with a currency broker in Toronto. This broker will then ask a business partner in Colombia, for example, to provide $200,000 worth of pesos to the drug trafficker’s agent in that country. The brokers in Toronto and Columbia will settle up accounts over time, as drugs and money move back and forth with various clients.

Five Eyes Probe

At an anti-money laundering conference in Toronto in 2017, Scott Doran, then a senior RCMP organized crime investigator who is now chief superintendent of international policing, confirmed the alleged links of the Mehdizadeh probe to Khanani’s network.

In his report to the conference, which included slides and pictures of Mehdizadeh and Khanani, Doran said the RCMP’s probe of Mehdizadeh started as an information-sharing initiative between the so-called Five Eyes intelligence partners, including the U.S., Canada, Australia, and the U.K.

Doran said that RCMP undercover officers were involved in two “cash drops” in Toronto that led them to Mehdizadeh.

Doran said Mounties kept Mehdizadeh under surveillance, and eventually took him down driving between Montreal and Toronto. The RCMP suspected that Mehdizadeh could be just one player in a massive underground banking scheme in eastern Canada, according to Doran, with suspected links to real-estate money laundering.

According to RCMP evidence filed in court and obtained by Global News, the Dubai company linked to the 9/11 attacks, Wall Street Exchange, had made a wire transfer to Mehdizadeh’s currency exchange, Aria.

An affidavit filed by the RCMP to retain evidence seized, said forensic investigators needed time to pursue all national and international angles of the case, and would also need his tax and banking information in the seizure, and to consider “potential production orders on banking institutions to determine a legitimacy of the source of funds.”

Media reports on the Five Eyes probe of Khanani that focus on the successful partnerships between Australian police and the DEA, say that Khanani was lured into providing cash money-laundering services for the DEA. Undercover agents would meet Khanani operatives in cities around the world, including Toronto, and provide them bags stuffed with hundreds of thousands of dollars, according to the reports.

The reports say these cash “mules” would deliver the fake drug cash to currency exchanges in these cities and wire transfers would be run through Dubai and back into the bank accounts used by DEA front businesses.

The Khanani organization employed myriad fake shell businesses around the world and a network of currency shop owners worldwide, according to the DEA and Financial Action Task Force (FATF) — an inter-government anti-money-laundering agency.

The FATF and U.S. government reports say the Khanani organization has laundered billions annually for the Taliban, and terrorist groups including Hezbollah and al-Qaida, as well as Mexican and Colombian drug cartels, and Chinese organized crime groups.

In 2017, Khanani was sentenced by a U.S. District Court in Florida to almost six years in prison for conspiracy to commit money laundering, the FATF report says.

“Extensive law enforcement co-ordination took place between multiple law enforcement agencies from Australia, Canada and the U.S., who all held a different piece of the puzzle,” the FATF report says.

Comments