WINNIPEG — If you are single income family with at least two kids, you may get a break on your taxes in the coming year.

“People with kids will save a lot of money on taxes because the federal government made some good changes to help out families with kids but at the provincial level we’re seeing some tax increases because of the way our tax system is set up,” Canadian Taxpayers Federation’s Colin Craig said Wednesday.

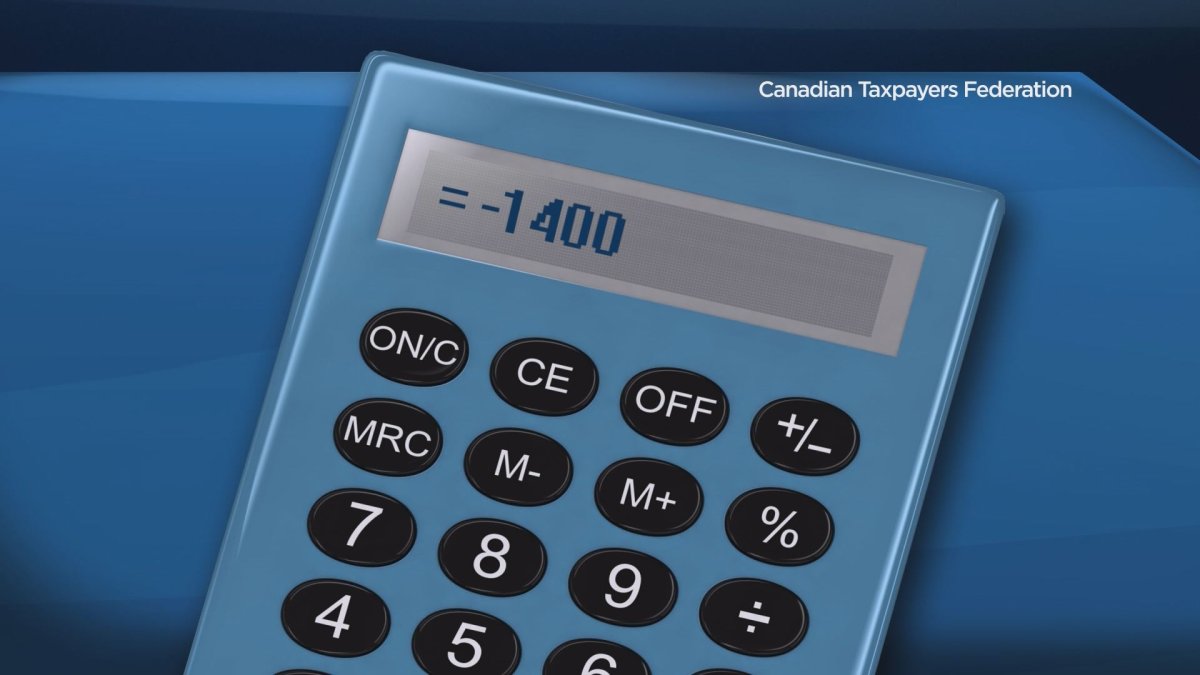

The Canadian Taxpayers Federation has made an analysis for the upcoming tax year, and say for a single income family with two children, which brings in $60,000 annually, taxes could drop by $1,400.

On the flip side, for a single income household where there are zero kids, the taxes will go up by about $50.

The upcoming changes to the Federal Tax landscape includes the Universal Child Care Benefit where families can receive up to $1,920 per year for each child under the age of 6, and introducing a new benefit of up to $720 per year for children aged 6 through 17.

The Family Tax Cut has also helped families save.

But the changes aren’t enough to help all Manitobans, according to Craig.

“On the provincial level we’re seeing these increases and they are impacting everyone but you’re just really noticing it for those who don’t have kids because they aren’t getting the federal benefits,” Craig explains.

The changes take effect January 1st, 2015.

- What is a halal mortgage? How interest-free home financing works in Canada

- Capital gains changes are ‘really fair,’ Freeland says, as doctors cry foul

- Ontario doctors offer solutions to help address shortage of family physicians

- Budget 2024 failed to spark ‘political reboot’ for Liberals, polling suggests

Comments