Calls for a soft landing for the housing market appear on the mark this year, with sales and price gains this spring “comfortably cool” across much of the country, experts at TD Economics and others say.

But there are some big exceptions.

Toronto, Vancouver and Calgary, already Canada’s priciest markets, are seeing home prices leap higher still as limited supply of some housing types and ultra low interest rates fuel bidding wars, particularly for single family homes.

“Most price pressures are coming from the single-family home market in Toronto, Vancouver and Calgary,” TD’s Diana Petramala said.

“Surveys show that bidding wars remain common in many major cities like Toronto, Vancouver and Calgary, which is why prices are continuing to grow at an uncomfortably hot pace,” the economist said.

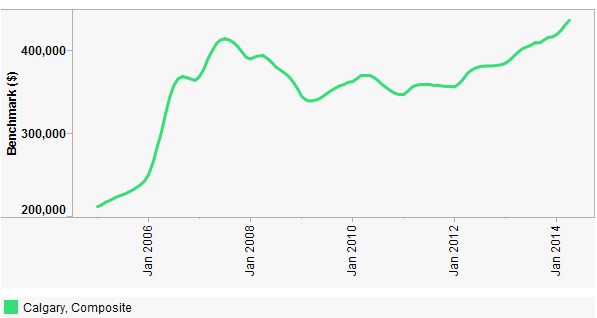

In Calgary, quality-adjusted prices surged 9.5 per cent last month, outpacing the 7.6 per cent gain in the national average home prices.

READ MORE: Home prices resume upward march, Calgary hits fresh high

But the national average was skewed by Calgary, Toronto and Vancouver – stripping out those markets leaves the national gain for April at a more modest 5.0 per cent compared to prices last year.

The average home price across all housing types (detached, semidetached, townhouse and condo) hit $409,708 in April, the Canadian Real Estate Association said Thursday.

That compares to the average selling price in the Toronto area of $577,898, up 10.1 per cent from April 2013, the city’s real estate board said.

The average home price in Calgary is $483,887, according to the city’s real estate board. In Greater Vancouver, the average home price is $619,000.

The gains come as borrowing rates on home loans hit fresh lows. Investors Group dropped its variable rate to 1.99 per cent this week.

Peter Veselinovich, vice president of banking and mortgages at the financial services firm, said the ultra low rates were only for buyers who met stringent creditworthiness standards.

“This isn’t a means for individuals who otherwise can’t afford a property or get a mortgage to get one,” he said. “This is for individuals that otherwise qualify comfortably to enjoy a lower rate.”

READ MORE: Mortgage rates hit new low as Investors Group cuts below 2 per cent

Still, some economists are concerned about the gulf that’s opened up between home prices and incomes, with gains in the former far outstripping growth in incomes in recent years — a gulf low-interest debt has rushed to fill in.

With even lower rates entering the market, “the risk is that prices re-accelerate as the spring market heats up,” TD’s Petramala said.

Veselinovich said the ultra low rate at Investors Group wouldn’t be around for long, and he expects rates to climb in short order.

“There was an opportunity for us, we had funding available,” he said.

WATCH: Will the big banks follow suit now that one mortgage lender is offering a three-year, variable rate mortgage for 1.99 per cent? And, will the federal government do anything to intervene? Robin Gill reports.

Comments