A strengthening loonie in recent years has sent Canadians over the border in record numbers, spending billions annually on clothing, electronics and other goods.

And with good reason – despite a narrowing of a decades-old gap between prices in Canada compared to the United States as the dollar has climbed, the gulf remains sizeable, a new report from Bank of Montreal says.

The cost differential of everything from diapers to running shoes to cars has come down, according to BMO chief economist Doug Porter, but not by much “with the price gap remaining substantial,” Porter said.

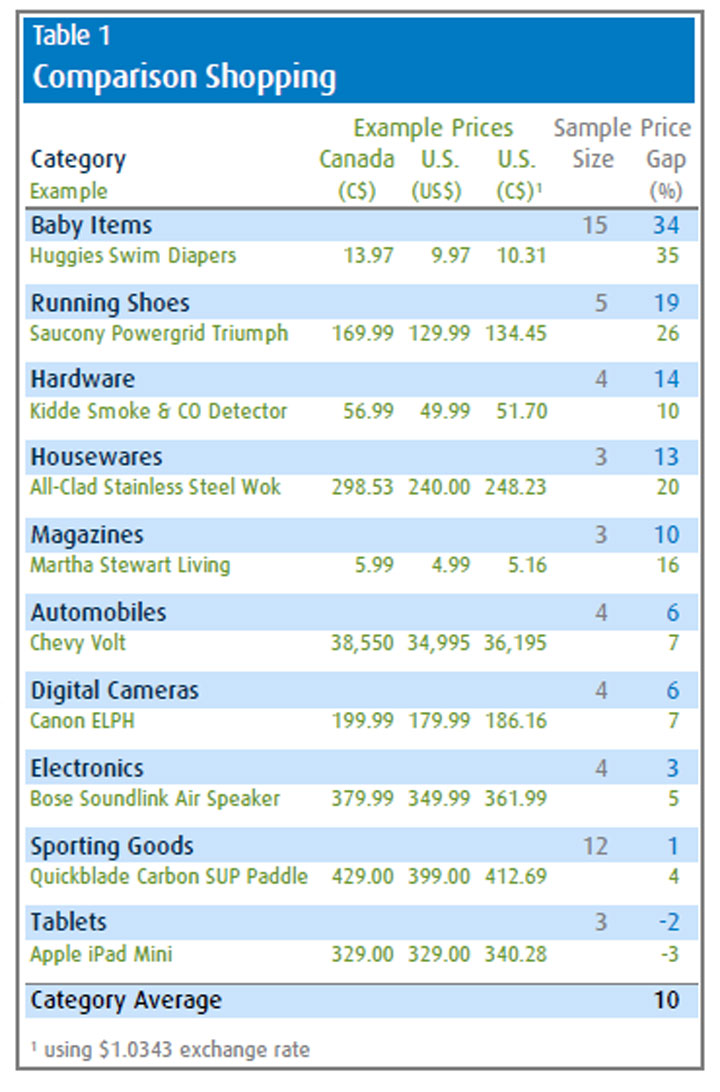

The average spread in price is about 10 per cent, the bank said, down from 14 per cent in a survey taken in May 2012.

“Most of the narrowing simply reflects the drop in the exchange rate,” BMO says. “Above and beyond the currency, we do find that the underlying gap is gradually narrowing—with the emphasis on gradually.”

Paying more money on the same item compared to its price in a U.S. store has annoyed and angered Canadian consumers for years.

A levelling of the loonie with the U.S. greenback in 2007 that’s persisted over the years has helped bring pricing more in line, especially on “high-profile” items that have been put in the spotlight for their wide price differences depending on what side of the border you’re on, the report said, like books and vehicles.

Domestic efforts and developments that should be bringing prices in line further haven’t been overly effective though, Porter said. The federal government’s tariff removal on a range of goods this year is too “targeted,” focusing on too few products to have much of an impact. The arrival of discount giant Target hasn’t done much to narrow the price gap, either.

- Life in the forest: How Stanley Park’s longest resident survived a changing landscape

- ‘Love at first sight’: Snow leopard at Toronto Zoo pregnant for 1st time

- Carbon rebate labelling in bank deposits fuelling confusion, minister says

- Buzz kill? Gen Z less interested in coffee than older Canadians, survey shows

Read more: Ottawa watching to see if retailers pass price cuts to consumers

“The much ballyhooed entry of Target into Canada appears to have had limited impact,” the bank report said. “The retailer itself even suggested that prices between the two countries need not be identical.”

When reached for comment, a Target spokeswoman said the Minneapolis-based retailer “built its business model to be competitive in the Canadian marketplace.

“Time and again it has been demonstrated that we are priced competitively with the lowest price leader in the market,” Target spokeswoman Lisa Gibson said.

“The reality is that there are factors that have been well-documented … that impact the cost,” Gibson said, citing higher transportation costs, packaging that requires both official languages and higher wages than what Target pays workers in U.S. stores.

“The fundamental problem is two-fold. First, Canada as a country carries about the same weight and sales potential as the state of California,” Doug Stephens, principal and analyst at Retail Prophet said.

Stephens said the growing “price war” between Target and Walmart should pressure down prices over the next while, forcing all retailers to react. “So consumers may get some relief,” he said.

Cross-border trips

The combination of better prices and a higher loonie has triggered an explosion of cross-border shopping trips in recent years.

“The fastest growing segment of outbound tourism is found in overnight trips to the U.S., which ebb and flow almost in perfect tandem with the Canadian dollar,” the BMO note said. “On the flip side, the number of U.S. visitors to Canada has been scraping all-time lows.”

The effect means there are now three Canadians headed over the border for every U.S. tourist coming to Canada, reversing a long-standing trend of American visitors to Canada outnumbering Canadian visitors to the U.S.

With populations packed close to the border, New Brunswick, Ontario and British Columbia see the most trips by overnight shoppers, the bank said.

The price gap and elevated loonie mean billions lost a year in tourism dollars and money that would have otherwise been spent in Canada, BMO says.

The bank expects the loonie to remain around 95 cents for the next year.

Here’s a look at some of the goods the bank compared prices on:

Comments