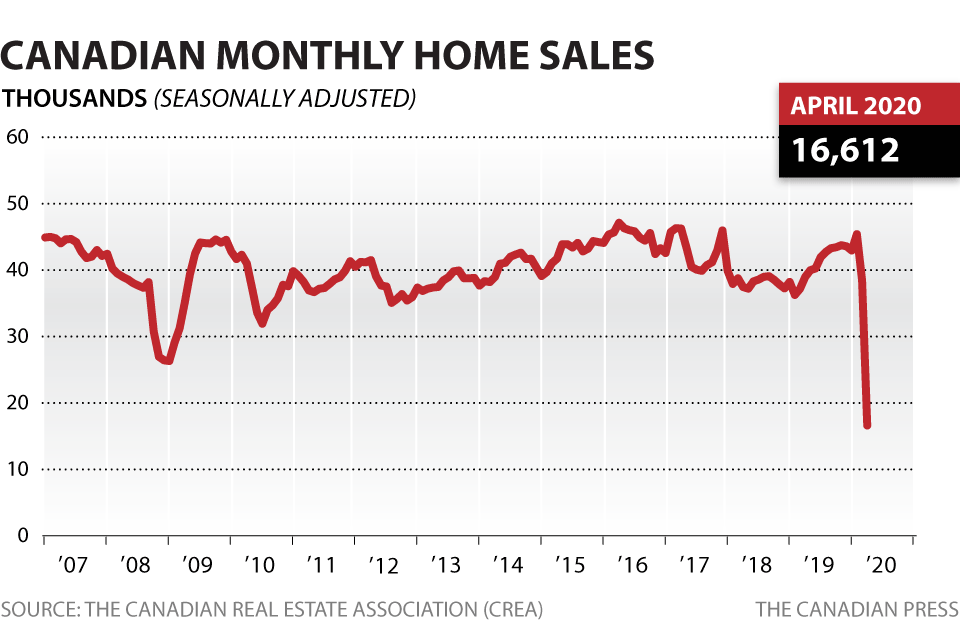

Canada’s home sales fell a record 56.8 per cent in April compared to an already weak March, the Canadian Real Estate Association (CREA) said on Friday.

Compared to a year earlier, April home sales were down 57.6 per cent, posting the lowest volume of transactions for the month since 1984.

Activity was down 66.2 per cent in the Greater Toronto Area, 57.9 per cent in Greater Vancouver, 51.5 per cent in Ottawa, and 42 per cent in Winnipeg.

Prices, however, did not show the kind of dramatic plunge some prospective homebuyers in pricey markets may be hoping for. Both supply and demand have largely frozen because of the novel coronavirus pandemic, the data suggests.

READ MORE: Landlords among most vulnerable homeowners during COVID-19 pandemic

The national average home price edged lower by just 1.3 per cent compared to April 2019, down to $488,000.

However, CREA’s home price index, which adjusts for changes in the mix of houses sold, was up 6.4 per cent year over year.

Nationally, the number of homes newly listed for sale dropped 55.7 per cent from March to April. The national sales-to-new listings ratio, which compares the numbers of sales to the number of homes available for sale, dipped to 62.4 per cent compared to 64 per cent in March and 65.4 per cent in February, CREA said.

However, inventory levels jumped to 9.2 months in April compared with 4.3 months in March as older listings stayed active while sales fell.

“Note that the months’ supply peaked at 9.7 during the financial crisis in late-2008, and these levels ordinarily suggest some pullback in prices,” BMO economist Robert Kavcic said in a note to clients.

But, he added, “when the market has effectively frozen, these metrics become a bit less reliable.”

— With files from the Canadian Press

- Some fixed mortgage rates are up despite hints of Bank of Canada cuts. Why?

- Lynx Air says passenger refunds will hurt investors because of defiant contractor

- As Tim Hortons tests plastic-free lids, how eco-friendly are alternatives?

- Airline industry weighs ‘heightened’ concerns amid Iran-Israel tensions

Comments