The B.C. government has introduced a new set of rules to further crack down on hidden ownership, money laundering and tax evasion in the province.

Starting in May 2020, private businesses will be required to keep transparency records of their true owners, including people or entities with direct or indirect control of the company or its shares.

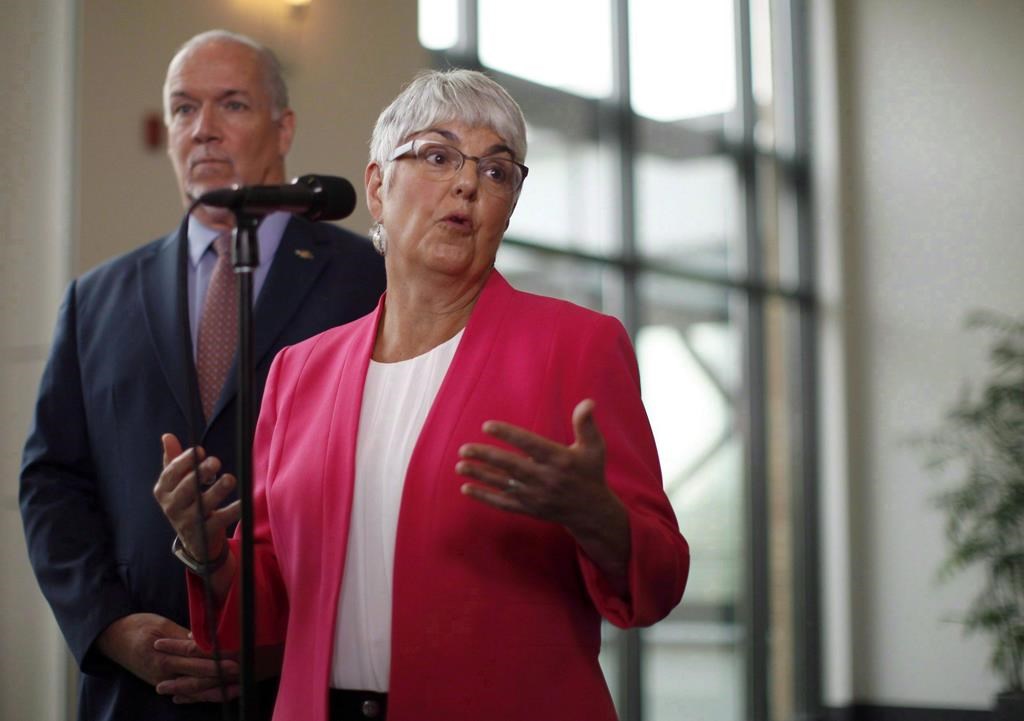

Finance Minister Carole James said in a statement the records will help drive down B.C.’s real estate market and prevent distortions to the provincial economy.

“Right now, businesses operating in our province can hide their ownership behind numbered companies and offshore and domestic trusts,” James said.

“This is hurting communities throughout our province that are dealing with the consequences of criminal activity and high home prices, and it needs to stop.”

The amendments to the Business Corporations Act will require the transparency records to include full legal names, dates of birth, citizenship information and the last known addresses of anyone found to be an owner of a private business.

- Man charged after doctor mistakenly shot in the face in downtown Vancouver: police

- Burnaby man charged in stabbing death of woman found on Vancouver street: police

- Second B.C. grant program facing scrutiny amid conflict concerns

- B.C. plants milestone 10 billionth tree since reforestation efforts began

James said hidden ownership can be used to avoid paying taxes and launder money. Multiple reports have found money laundering to be running rampant in B.C.’s real estate and gaming economies.

Maureen Maloney’s expert panel report released in May said disclosure of beneficial ownership would be the “single most important measure that can be taken to combat money laundering.”

That report estimated $7.4 billion was laundered through B.C. in 2018 alone — $5 billion of which was laundered through real estate.

The panel found that illegal activity contributed to increasing the cost of buying a home in the province by at least five per cent.

“The previous government let criminals shelter the illegal proceeds of crime, but we are listening to British Columbians, experts and municipalities to end hidden ownership,” James said.

“Requiring businesses to maintain transparency registries means that criminals cannot hide what they own and that people are paying their fair share.”

Ministry of Finance officials, including auditing officers, and police will have access to the transparency records. James said information may also be shared with the Canadian Revenue Agency to help stop tax evasion.

The amendments will come with the creation of a new, publicly-accessible registry of who owns real estate in B.C.

The Land Owner Transparency Act — which the province says is the first of its kind in Canada — provides tax auditors and law enforcement agencies, as well as federal and provincial regulators, the information needed to help with investigations.

Legislation was put forward in the spring and received royal assent in May.

The legislation includes the disclosure requirements in three situations:

- On any application to register an interest land in the name of a reporting body

- Any time there is a change of interest holders or beneficial owners (even when this does not result in a transfer of legal title to the land)

- During an initial transition period, all those holding an interest in land for a beneficial owner will be required to file a disclosure report

— With files from Richard Zussman

Comments