Lisa Cesario and her partner are frustrated after trying to buy their first home. They’ve been house hunting in the Ottawa real estate market for six months and have been outbid twice for homes that ultimately sold for $75,000 to $100,000 more than their offers.

“We want to invest in our future. I don’t want to be paying rent in 25 years if I can avoid it,” Cesario told Global News. “I’ve worked hard to save for a down payment.”

Cesario, 39, works as a middle school teacher in Gatineau, Que., and is worried that Ottawa’s housing market is more and more like those in Toronto and Vancouver, where sky-high prices have made real estate increasingly unaffordable.

She thinks real estate speculation is driving up the costs of homes and pushing families out of the market.

RBC economic data backs up her concerns. The bank found in 2018 that Ottawa has replaced the Greater Toronto Area as the housing market with the highest presence of foreign homebuyers after Vancouver and Victoria.

“It’s obviously a great concern,” she said. “As someone who is thinking about starting a family, how could my kids even ever afford a house?”

READ MORE: Liberals, Tories unveil home renovation tax measures to help fight climate change

Cesario, like many Canadians, says housing is among the top issues in this federal election, even if she hasn’t been paying attention to everything the party leaders are promising.

According to an Ipsos poll conducted between Sept. 11 and 13 for Global News and La Presse, the cost of living was among the top issues for voters, with 27 per cent of respondents saying it was the most important to them. Only health care finished higher.

Housing is also the biggest expense for most Canadians, according to the latest numbers from Statistics Canada. Households spent an average of $18,637 on shelter in 2017, up 3.4 per cent from 2016. This includes rent, mortgage payments, repairs and maintenance costs.

In Ontario and B.C, for example, individuals were spending more than 30 per cent of their income on shelter costs. In New Brunswick and Newfoundland and Labrador, it was closer to 24 per cent.

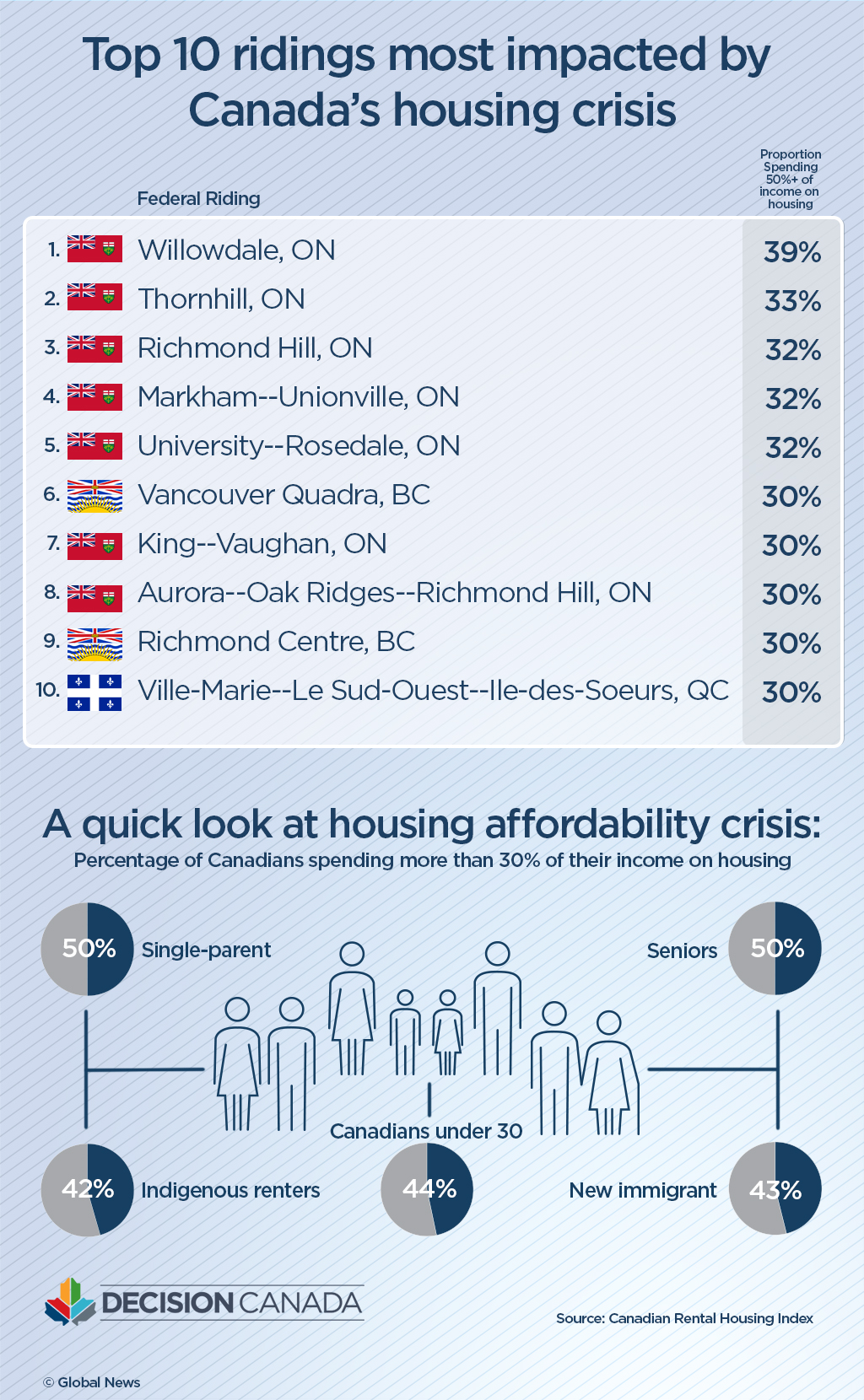

When it comes to renting, the Canadian Rental Housing Index broke down how much of their overall income Canadians are spending on rent across all 338 federal ridings.

The report, released in September, used StatCan’s 2016 long-form census and highlighted key electoral districts where voters are spending 50 per cent or more of their income on housing to better inform voters and politicians.

Not surprisingly, the data showed Ontario led the country when it came to housing affordability issues with 11 of the 20 worst ridings, according to the report.

READ MORE: What has the Trudeau government done for you on housing affordability?

The top five federal ridings where Canadians spend more than half their incomes on rent were found in the Greater Toronto Area. More than 30 per cent of renters in Willowdale, Thornhill, Richmond Hill and Markham are spending more than 50 per cent of their income on rent, the report found. The Richmond Centre and Vancouver Quadra ridings in B.C. were also among the most impacted by the housing crisis.

“The data clearly demonstrates that our political leaders have not been able to find or implement meaningful solutions to the affordable housing crisis,” said Marlene Coffey, executive director of the Ontario Non-Profit Housing Association, in a statement. “Ontario now has the dubious honour of being harder-hit than anywhere else in the country.”

What are the parties promising?

Over the course of the campaign, the four main parties have unveiled a number of measures aimed at tackling the housing crisis.

The Liberals have pledged to build 100,000 affordable homes over the next 10 years and want to expand the First-Time Home Buyer Incentive for people in Victoria, Vancouver and Toronto. The value of a qualifying home will go from around $500,000 to nearly $800,000.

They are also promising to put a one per cent tax on absentee foreign owners and want to retrofit 1.5 million homes for energy efficiency and offer interest-free loans up to $40,000 to make houses weather-resilient.

Conservative Leader Andrew Scheer has said he would raise amortization limits to 30 years for all insure mortgages and review the mortgage “stress test” for first-time buyers. He’s also promised to launch an inquiry into money laundering in the country’s real estate sector, which has been found to be a contributing factor to the soaring real estate market in Vancouver.

Rob McLister, founder of mortgage rate comparison website RateSpy.com, said the proposals from the main parties are too focused on the demand side of Canada’s housing problems and don’t do enough to target the supply side.

READ MORE: What to know about the Liberals’ new housing-incentive promise

In 2018, there were 37,000 new apartments built nationwide, but demand increased by 50,000 units, according to the Canada Mortgage and Housing Corporation (CMHC). Ontario and British Columbia continued to have the lowest vacancy rates at 1.8 per cent and 1.4 per cent, respectively.

“You can take all of the demand-side proposals from all of the parties and assign very little weight to them,” McLister said. “The thing that I think is going to help alleviate the affordability crisis in Canada most are supply-side solutions. That means incentivizing development.”

READ MORE: B.C. says speculation tax brought in $58M in 2018 as meetings with mayors on tax kick off

McLister also said parties should be more focused on high-speed transit to take people from low-cost areas to higher-cost areas.

“Some of the greatest pressure is in the middle class,” he said. “These are folks that are living paycheque to paycheque, earning sometimes sizable salaries but not able to get ahead because the cost of living is too high.”

John Pasalis, president of real estate brokerage company Realosophy, was also skeptical about the promises from the Grits and Tories.

He said his clients are simply not applying for the Liberals’ shared-equity program. CMHC has not released figures on how many people have signed up for the program.

“Anecdotally, the buyers that we’ve talked to, most have no interest in doing that. Maybe they would rather just buy the home on their own,” Pasalis said.

He warns that increasing the amortization period may help people get into the market in the short term but will ultimately push home prices in Toronto and Vancouver higher.

Mortgage “stress tests” were put in place to cool down the accelerating housing market, which was contributing to high levels of household debt, Pasalis said. Lengthening amortization periods to reduce monthly payments might just cause homebuyers to borrow more so they can pay higher prices, he said.

“It’s going to allow them to take on more debt, which is going to encourage a lot of them to take on more debt and spend more on their home, which, again, stimulates buying demand.”

Evan Siddall, chief executive of CMHC, offered similar warnings back in May when he testified before a House of Commons finance committee that bringing back 30-year amortizations would push home prices up by one to two per cent in major cities.

“My job is to advise you against this reckless myopia and protect our economy from potentially tragic consequences.”

The New Democrats have promised to spend $5 billion to create 500,000 affordable housing units over 10 years and want to remove the federal GST/HST for those building new affordable units.

The party would also reintroduce 30-year mortgages for first-time buyers and give low-interest loans to retrofit houses. NDP Leader Jagmeet Singh is also calling for a 15 per cent tax on foreign buyers and has called for a money laundering inquest into the real estate sector.

McLister said that while the NDP’s plan sounds “good on paper,” there are a lot of unanswered questions.

“We don’t know how they’re going to do it. We don’t know what income brackets will benefit from that housing,” he said.

The Green Party wants to make more resources available for housing co-ops as well as build 25,000 new affordable units and renovate 15,000 others every year for the next 10 years. Green Party Leader Elizabeth May has also said she would appoint a minister of housing to oversee the National Housing Strategy.

Experts gave top marks to those parties that support a national money laundering inquest in the real estate sector and also to those that have proposed taxes on foreign speculation.

“That would really curb some of the bad behaviours we end up seeing in the housing market,” Pasalis said. “When you have something like this that’s federal, it definitely helps.”

For Cesario, she is still evaluating the platforms before making a decision at the ballot box on Oct. 21.

“I think it’s really important for Canadians to be able to afford homes in the cities that they grew up in,” she said. “It’s not healthy for communities because then there’s no soul left in the community.”

Comments