With housing prices continuing to increase, there has been a lot of focus on who’s buying Metro Vancouver real estate.

Calls for government to do something to make home prices “more affordable” have grown louder.

But what happens if there is a market correction, caused either by government action or market forces?

Some say that’s always a good thing.

So how true is it, especially for the region’s baby boomers and seniors?

Demographic shift

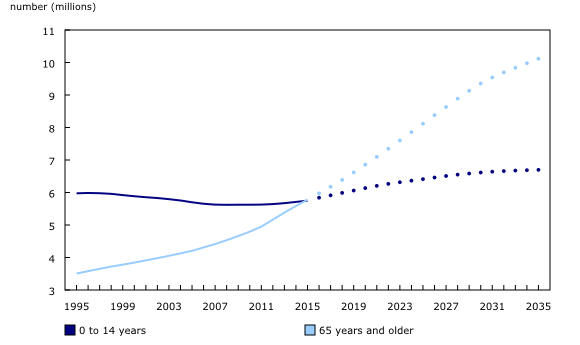

Canada’s population is aging.

According to Statistics Canada, for the first time there are more people aged 65 and older than children under the age of 14. Seniors make up 16.1% of the population now, and are expected to account for 20.1% by 2024.

Canadians are also living longer.

Life expectancy is now 80 years for men and 84 for women, up from 74 and 81 just 15 years ago.

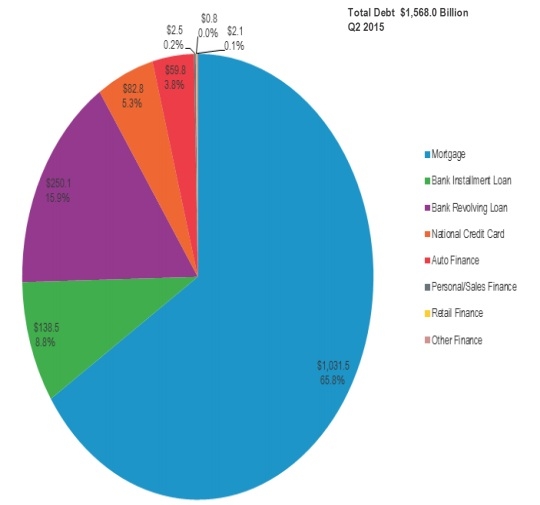

We also know that consumer debt loads are increasing amongst seniors.

A recent study from credit firm Equifax suggests those over the age of 65 are taking on more consumer debt at a faster pace than other Canadians. The debt growth rate amongst seniors is 4.9-percent, compared to 2-percent for Canada as a whole.

But despite those increasing debt loads, experts say most of Canada’s seniors are on track to be financially secure in retirement. That’s the suggestion made in reports from both McKinsey and the C.D. Howe Institute.

LISTEN: CKNW’s Charmaine de Silva’s How True Is It?

Uncertain market

But what if Metro Vancouver housing prices dropped?

The impact for many seniors and those nearing retirement may not be so good.

Lachlan MacPherson is a Partner at MNP, one of Canada’s leading accounting, tax and business planning firms.

Along with working with high net worth individuals, he helps seniors with their financial planning.

“I find a lot of them really don’t have the saving necessary to carry them through a long-term retirement. 20 years ago people just didn’t live as long, and now they live a lot longer. The retirement fund you need when you’re 55 or 60 and you’re trying to stop work and not have a steady form of income is significant.”

So how much are people relying on home values increasing to help out in their golden years?

MacPherson thinks they are quite a bit. And he says a price drop would hurt a lot of people.

“To have the values go down could be significant. It can be a situation where they really need the additional funds, their home is not going to generate that asset, that income for them to have a comfortable retirement.”

Targeting the wealthy?

What about measures that would only target luxury properties?

MacPherson says he understands why those would seem like a good idea… but he suggests forcing those prices down could have negative repercussions as well.

“Some of those families may have lived in these homes for 20, 30 years and it doesn’t mean they’ve been high-income earners, just that they were fortunate enough to acquire real estate at a very reasonable price where now it’s totally unreasonable.

If they’re able to get a huge windfall, that’s great. But I could bet you some of those situations, that people still have mortgages on their property, or they’ve remortgaged their property again for cashflow. It’s not necessarily going to be someone who’s extremely rich just because they’ve sold their house.”

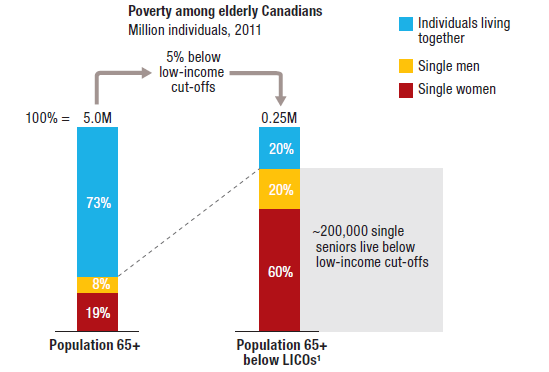

Seniors at risk

MacPherson’s sentiments are echoed by BC’s Seniors Advocate.

Isobel Mackenzie says a housing market that goes down is a worry for many older British Columbians, who don’t want to see the province interfere to lower prices.

“I think seniors would see a problem with that. I think that many are counting on the equity in their home for future decisions about care needs that they might have.”

In fact, she has been pushing for government help to access wealth held within seniors’ homes.

“I think the government, I hope, sees itself as having a role in facilitating sustainable and responsible ways of seniors being able to access some of the equity in their homes to help with some of their future needs.

That would be a non-starter in a housing market where prices were falling.

But all situations where house prices would decrease are not equal.

MNP’s Lachlan MacPherson says some situations are far worse than others… in particular, those where the market doesn’t just adjust by itself.

“If housing prices across the board are going down it’s not something you can really control. What you usually find is the whole cost of living goes down. But to have an intervention that is artificially forcing these prices down may be kind of dangerous.”

The danger, partially because if the price of everything does not go down with the price of real estate, seniors may not see any benefit from the loss of financial security and flexibility.

Bottom line?

If there is a market correction, for any reason, many seniors will feel the impact.

And they may not have decades in the workforce left to continue paying a mortgage like some of their younger counterparts.

Comments