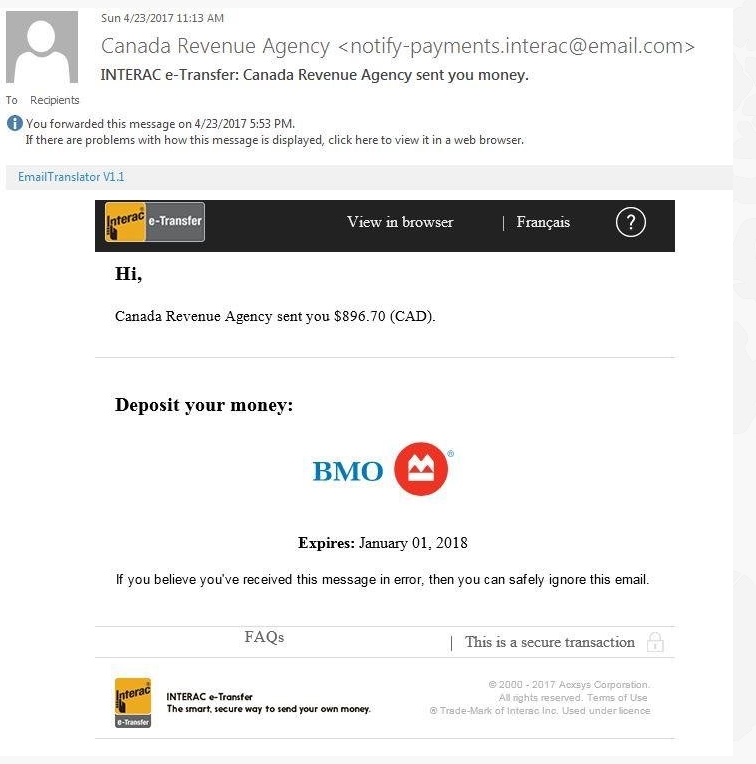

If you’re waiting on a tax refund this year, beware of what has become one of the top phishing scams in the country — an email that might look like this:

The screenshot appeared on a popular thread on social media site Reddit on April 23, posted by a user who flagged it as a fraudulent attempt to acquire personal information.

Bogus emails about tax refunds are one of the two most popular phishing scams in Canada, according to the Canadian Anti-Fraud Centre (CAFC), a government agency that collects fraud information and intelligence. The other blockbuster email sham is a fake message from what looks like a bank or other financial institution warning recipients of suspicious activity on their account, CAFC told Global News.

READ MORE: CRA income tax phishing scam still going strong, police warn

In both cases, as with most phishing scams, the emails contain a link that directs victims to an official-looking website that prompts them to provide personal information such as credit card, bank account and social insurance numbers.

The end of tax season, though, is high season for tax-refund swindles, in particular.

“This year we’re starting to see a lot of more of these email phishing scams,” Canada Revenue Agency spokesman Paul Murphy told Global News.

READ MORE: Tax season, scam season: Don’t fall for CRA income tax email scams

“It’s extremely frustrating. This is something that’s been going on now for a couple of years and it just doesn’t seem to go away,” he added.

READ MORE: Tax season brings tax scams, warns CRA

So how do you tell whether it’s really the CRA trying to get in touch?

Ways to detect email tax scams

The first thing to know is that the CRA doesn’t generally send emails.

“The main way in which the CRA communicates with Canadians is through the mail,” said Murphy.

You would only receive emails from the agency if you’ve signed up for specific services, of which you’d be well aware, he added.

In general, the CRA will never:

- Send payments using Interac e-transfer. The agency relies exclusively on direct deposit or cheque.

- Ask you to provide your personal or financial information by email, text, or by clicking on a link.

- Ask for information about your passport, health card, or driver’s licence.

- Request payments by gift cards or pre-paid credit cards.

WATCH: Do not pay your taxes with gift cards: Edmonton police

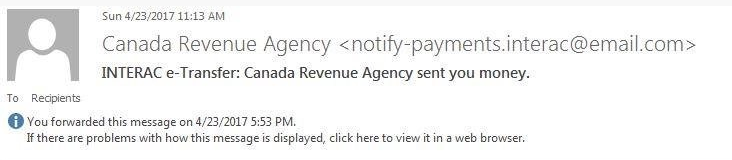

Another surefire way to detect a email scam — CRA-related or otherwise — is checking the sender’s address. In the example below, the message comes from notify-payments.interac@email.com. Although the fraudsters took pains to come up with a legitimate-looking email, it’s clearly not a government email address, which would normally end in “gc.ca.”

A third tip to avoid an email hoax is examining any links it contains. While attackers often use a legitimate website in the text of the email, holding your mouse over the link will reveal the actual URL the link will take you to.

Take care not to click on the link, however, as it could lead you to a website containing malicious software.

WATCH: CRA phone scam ramps up again before tax time

How to recognize a fake CRA phone call

If you owe taxes this year, you might be more likely to fall for another well-tested CRA scam: phone calls where fraudsters posing as employees of the tax agency coax victims into revealing their banking information in order to settle an alleged debt to the government.

Usually the conversation starts out in a civil tone, with the caller claiming the taxpayer made a mistake on her or his return or didn’t file. As the call progresses, though, fraudsters generally become more aggressive, often resorting to threats in order to scare their targets into coughing up credit card or bank account details.

A CRA officer would never do that, said Murphy.

“If you get a call from somebody saying that you’re going to go to jail if you don’t pay up — that’s not the CRA calling,” he noted.

More information of tax-related fraud is available on the home page of the CRA website.

WATCH: Watch a tax scammer get caught in lies after threatening to arrest Wisc. cop

Comments