A B.C. woman who was badly injured in a horse riding accident last year says her accident insurance policy will not pay her the amount she says she’s owed.

Katie Muller, 29, lives in Parksville and purchased accidental death and dismemberment insurance from the Horse Council of BC. The policy was worth $30,000 and provided coverage if the person suffered “a catastrophic and permanent injury (or death) related to an incident where horses are involved.” Under that policy, the person was covered 24 hours a day, seven days a week and anywhere in the world.

“I had just bought it in October because I was doing a horse show,” says Muller. “If you are doing a horse show it’s absolutely mandatory that you have this insurance. You have to go through Horse Council to get this insurance.”

The insurance is then issued by Capri Insurance.

A few weeks after competing in the horse show, Muller was out riding with a friend when she fell from her horse and broke her neck. She was instantly paralyzed from the armpits down.

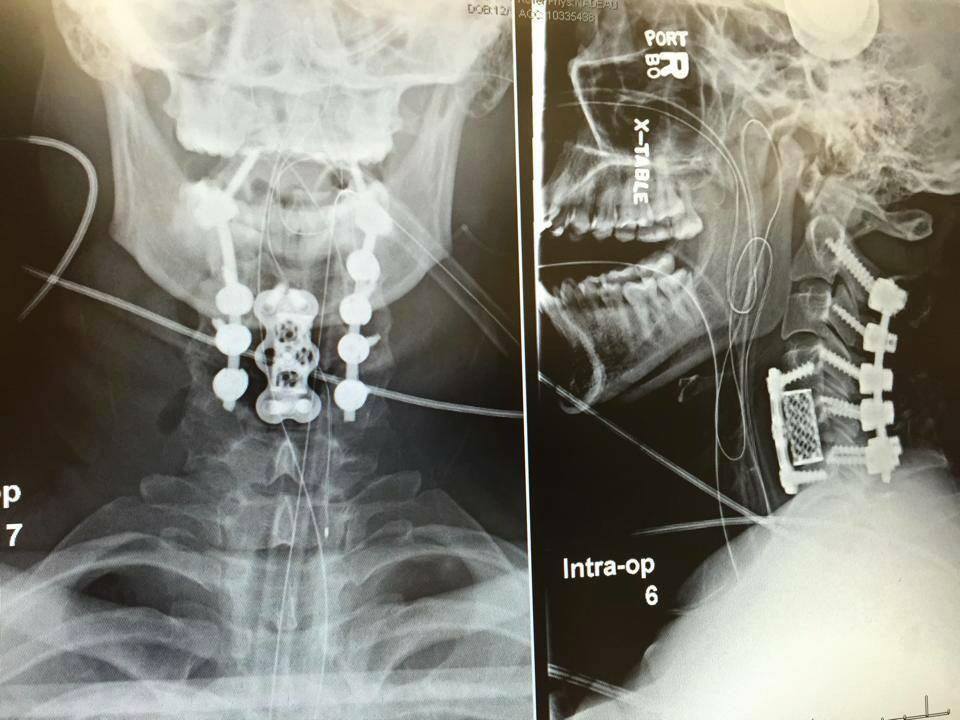

She has since undergone surgeries and months of intense physiotherapy.

In a post on Facebook, Muller details how much her life has changed, and although she is now back on Vancouver Island and living with her mother, her life will never be the same.

1 year later, I CAN walk with a walker. I’m so grateful for this, but I can only walk in the house and it’s not functional. My balance is completely gone, so I can’t let go of my walker to carry things like a cup from the living room to the kitchen. I have very low endurance, so I can only sit straight up, unsupported, for a few minutes at a time. I can’t walk long distances, like the grocery store or down the street with my dog. My blood pressure is still unstable so I can only stay on my feet for about 7 minutes. To do anything functional like work, shop, cook or daily chores, I’m in my wheelchair. This is absolutely a permanent injury.

Muller says she was expecting to receive the money from her insurance policy soon, as the one year anniversary of the accident was coming up, but on Thursday she found out her claim had been denied.

“No explanation, just ‘you’ll get a letter of why we’re denying you in the mail’,” she says.

Muller calls the situation “ridiculous.”

“I work really really hard and I am, on the scale of what’s happened I am doing very well,” she says. “When they originally diagnosed me I wasn’t going to have any sort of recovery, so in that sense I’m doing really well, but I’m not even, when you look at my old life it’s not even comparable how different it is.”

While her youngest son is living with her and her mother, Muller’s older son lives with her husband in Victoria as he needs to be there for work.

Muller writes on Facebook:

The physical loss of this injury is bad, but the emotional part of it is even worse. I was a strong independent mother, equestrian, business owner, military wife, with a fierce love for life. Now every morning when I wake up I need to make an effort to be happy and every night when I go to sleep I deeply grieve for my old life. This injury has effected everyone close to me emotionally, mentally and financially in a very negative way. My 4 year old will never remember his mother without a disability, that alone is catastrophic and permanent.

She would like to see the Horse Council revisit her claim and see if anything can be done.

“Even just talking to someone who would be reasonable and listen to my side of the story about how this is very permanent and catastrophic,” she says. “That would definitely help I think.”

Global News reached out to the Horse Council of BC for comment, but did not hear back.

However, the company has posted a statement on their website:

We have just been made aware of a situation involving a member regarding an accident within the past year. While we are not privy to any information regarding specific claims due to privacy laws put in place by government to protect individuals, please be assured we are taking this very seriously. HCBC is communicating with Capri Insurance our insurance broker, who is similarly investigating the incident on behalf of the member.

We are dedicated to providing our members with the best service possible in the equine industry to allow individuals to enjoy their horses and participate in our common passion.

Jason Baughen, operations manager at Capri Insurance, has also issued a statement:

This is an unfortunate accident and our first concern is for Katie and her family. Capri Insurance and Horse Council of BC have supported British Columbia’s equine community for many years. This morning, we were made aware that her claim was denied and have since been gathering information. We’ve spoken with Katie today and she’s aware that we’re actively engaged and advocating on her behalf. We always advocate strongly on behalf of our clients and Katie will be no exception. We’ve discussed next steps with Katie and will work with her and the insurer toward a fair and equitable outcome.

Comments