The federal Conservatives have indicated they’re going to double the amount Canadians can invest in tax-free savings accounts each year, from $5,500 to $11,000.

“Canadians know that we stick to our commitments,” Finance Minister Joe Oliver said in a letter to Tory MPs Tuesday, apparently referring to a pledge in the last election to double the limit once the budget was balanced. “I will present a balanced budget that will make life more affordable for Canadians.”

READ MORE: Oliver promises balanced budget law

TFSAs, first created in 2009, are supposed to be an easy incentive for ordinary Canadians to save more for retirement.

Evidence indicates they haven’t been.

Savings rates actually dropped since 2009, Statistics Canada indicates. And they’re well below what they were in 1990.

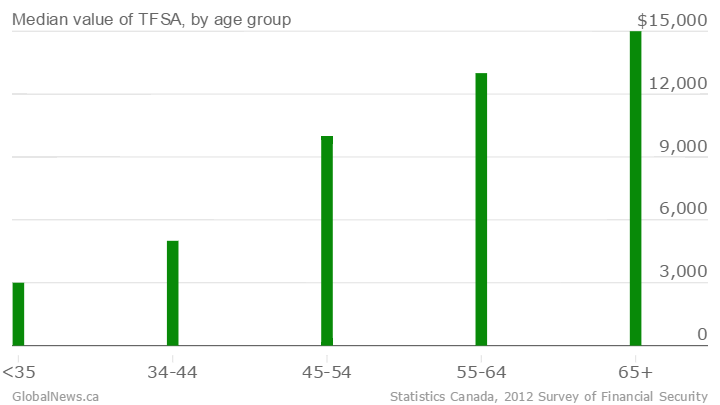

“The TFSA program is regressive, overall,” the Parliamentary Budget Officer said in a report this year.

“Benefits skew to higher income, higher wealth and older households.”

Not only will growth in individual contribution limits offer “no additional benefit” to low- or middle-wealth households, the report estimates, but doubling the limit will make the program even more regressive when it comes to wealth: The wealthiest households will benefit 10 times as much as low-wealth ones.

- Train goes up in flames while rolling through London, Ont. Here’s what we know

- Budget 2024 failed to spark ‘political reboot’ for Liberals, polling suggests

- Wrong remains sent to ‘exhausted’ Canadian family after death on Cuba vacation

- Peel police chief met Sri Lankan officer a court says ‘participated’ in torture

Between 2015 and 2080, the PBO report estimates, low-income households will get as little as a quarter of the median benefit of the program — an inequity that will increase over the life of the program.

They just don’t have enough cash to save, says Armine Yalnizyan, a senior economist with the Canadian Centre for Policy Alternatives.

“The issue is not one of profligacy. The issue is that costs are rising and wages are not rising at the same rate,” she said.

“If savings come from having enough to save, how much you earn makes a difference.”

Increasingly precarious work and decreased access to employment insurance are making it harder for young people to save at all, Yalnizyan said.

“Your savings become what used to be the unemployment insurance fund.”

READ MORE: Canada’s instability trap

At the same time, the expanded program will eventually cost the federal government almost $15 billion a year, while at the same time taking close to $8 billion a year from provincial coffers.

That doesn’t faze B.C. Finance Minister Mike De Jong.

“When Canadians save, they save for a period of time, they save for a purpose. And then ultimately … they spend,” he said in an interview.

“So of all the things that perhaps keep me awake at night, the fact that Canadians might be provided with a tool that enhances their ability to save, or encourages them to save, is not one of those things.”

The Canadian Taxpayers Federation, for its part, thinks doubling the TFSA limit is a great idea.

“We’re generally in favour of any policy that leaves more money in the pockets of Canadians,” said federal director Aaron Wudrick. “There’s other ways to address the regressive aspect” of the program — by increasing direct transfers to lower-income or lower-wealth Canadians, for example.

But Yalnizyan argues the tax-free savings accounts can be used by wealthy Canadians as tax shelters. And because programs such as a Guaranteed Income Supplement for seniors are calculated based on taxable income, people could be qualifying for that government subsidy when they shouldn’t be, she said.

“You have to wonder, is that where we should be losing revenues that also buy great services for people, that could provide cheaper transit or higher quality childcare?”

She argues a better way to help young people save is to either lower the cost of education and housing — two expenditures whose costs have vastly outpaced both inflation and wage growth — or raise incomes of the lowest earners.

“For people that have not as yet been able to save, the primary thing is making sure they get paid more, not less.”

READ MORE: Full federal budget coverage

Frances Woolley, economics professor and Associate Dean of Public Affairs at Carleton University, thinks tax-free savings accounts are a good idea in principle. But without proper restrictions, she says, they risk becoming a massive drain on the public purse even as the country’s aging population eats away at the tax base.

She’s concerned at the prospect of older, richer Canadians — especially those who find themselves obliged to take money out of their RRSPs — using tax-free savings accounts as places to accumulate significant amounts of wealth that become permanently lost to governments for tax purposes.

“There is a serious potential for abuse of these programs and erosion of the tax base and erosion of our ability to tax income,” she said.

“It’s terrific as a savings vehicle for lots of people; the concern is when people have maxed out their RRSP room and they use them in ways they are not intended.”

And the people who can afford the most creative accountants will be those with the most money.

“If you had a lifetime limit on contributions, doubling it wouldn’t be such a bad deal,” she said.

“If we don’t have some kind of lifetime contribution limit, it’s a potential disaster.”

The new TFSA policy “does benefit wealthy, older Canadians. You can read the politics of that as you wish.”

Tell us your story. Do you have a TFSA? Have you maxed it out, and do you plan to take advantage of doubled limits? We want to hear.

Note: We may use the story you send us in this or future articles. While we may contact you, however, we won’t publish or share that information with anyone.

Comments