How would a two-percentage point hike in interest rates impact the housing market? It’s a matter of timing, a new note from BMO Economics said Friday.

With many homeowners carrying mortgage loans with an interest rate of between three, four or five per cent, a sudden rate spike of two full percentage points would mean a substantial hike in monthly payments, and for some, could spell financial ruin.

A quick swing of that magnitude could in fact trigger a crash, according to BMO.

“If we were to get that increase overnight, housing valuations would be stretched to levels that preceded significant corrections in the past,” Bank of Montreal economist Robert Kavcic said.

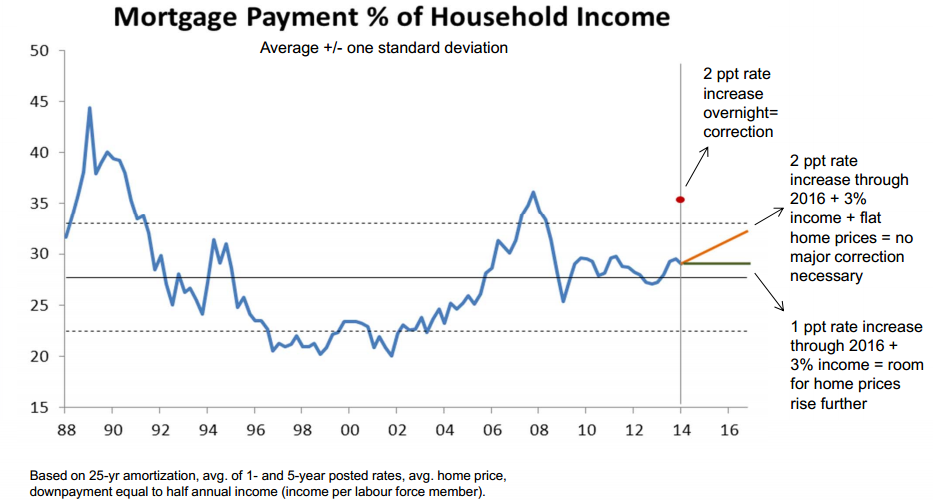

BMO says the average household is now dedicating about 30 per cent of its income to mortgage costs (Kavcic excluded utilities and property taxes).

That’s well within normal boundaries that have been established over the last quarter of a century — thanks again to lower interest payments because of lower rates, even as prices continue to rise far faster than incomes.

Can you afford your home? Use our mortgage calculator

A two-point rate spike would likely send home values plummeting however as overburdened homeowners scrambled to sell, BMO says.

In a chart (below), Kavcic shows previous corrections where the financial burden of an “average” mortgage climbed sharply and left households over-leveraged (in the 1989 crash and again just before the 2008 correction).

A sudden two-point rise would bring the financial burden on average homeowners to levels that precipitated the 2008 downturn, BMO shows.

The closest we’ve come recently to that kind of climb was last summer’s modest but swift rise of seven tenths of a percentage point, as hopes of a stronger U.S. recovery broadly lifted bond yields that influence interest rates.

They’ve since drifted lower again, with big banks and other Canadian lenders offering sub-three per cent home loans again, while the consensus among many is for rates to remain at these historically low levels for some time.

READ MORE: Expect low interest rates for years, Bank of Canada head says

A second scenario painted by the BMO note was a gradual two-point rise through to 2016, a more likely outcome than the doom pictured above.

That would leave home prices flat, Kavcic says, with “no major correction necessary.”

A third scenario envisions the rate hike cut in half, with interest rising by one percentage point from their current levels through 2016.

That would leave “room for home prices to rise further,” the economist said.

WATCH: Home prices in Toronto continue to march higher and higher. Can the boom last?

Comments