Video: Canadians are experiencing pain at the pumps as gas prices have risen close to all-time highs, in recent weeks. Shirlee Engel explains what’s behind the latest increase.

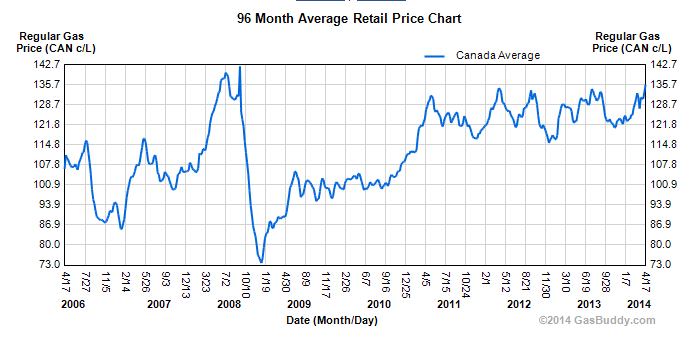

A return to near-all time highs for gas prices this week is creating grief for motorists and commuters.

In surburban Toronto, a litre is about $1.39 at many stations at the moment, according to gasbuddy.com, a site that tracks North American retail gas prices. In Victoria, it’s $1.43.

A month ago, gas was 10 cents cheaper virtually across the country.

Experts note gas prices move generally in line with oil prices.

“There’s a few layers there. But generally what you pay at the pump tends to move very closely with the price of oil,” Doug Porter, the chief economist at Bank of Montreal said.

Gas’ underlying commodity, oil, is trading at about US$104.5 a barrel, up about five per cent this year. Gas meanwhile has shot up about eight per cent in recent weeks.

Still, in the summer of 2008 — when gas prices first soared to the record levels we’re now testing again — the price of oil had exploded to an all-time high of $147 a barrel, Porter and others note.

Oil is about 30 per cent cheaper than its peak price, so why is gas so much higher?

Factors driving prices up

BMO’s Porter and other experts say there are mainly three factors to consider in the recent run-up:

- Seasonal demand is rising as the winter fades (in theory) and the driving season arrives.

- World demand in general is elevated because the unusually harsh winter, not to mention some geopolitical tensions between Ukraine and Russia, a big energy producer.

- The Canadian dollar, now trading at around 91 cents US, has weakened against the U.S. dollar in recent months meaning gas bought in U.S. dollars – the default currency wholesale gas is priced in — automatically becomes more expensive for Canadian consumers.

Oil’s rise coupled with the currency swing amounts to about an 8 per cent climb in gas prices, Porter said.

Jason Toews, a co-founder of gasbuddy.com and retail gas pricing expert adds another factor to the list of inflationary drivers. Refineries have to begin adding chemical additives to reduce emissions over the summer, an annual routine that can constrict supply.

“There’s few other factors in play,” he said.

WATCH: The Morning Show’s Liza Fromer and AM640’s John Oakley talk about the frustration of rising gas prices.

There’s also a final factor to consider.

Bigger profits for gas companies and stations

BMO’s Porter notes that as gas prices have risen, “refining margins have gone up” among big oil firms (margins meaning profit margins).

Toews cautions the market that dictates gas prices in Canada and around the world is one of the most complex on the planet.

“It’s obscured because there are multiple parties with their hands in the pie. There’s the oil producing companies — and countries. There’s the refining level, then there’s retail,” he said.

“And everyone wants to get their own profit.”

Still, looking over real-time gas prices in the Greater Toronto Area, the analyst wondered aloud why the per-litre price at a Costco Wholesale location in Oshawa was 1.30/litre, while some big-name chains and independent operators across the city were selling gas for as much as $1.44/litre.

“What explains that 14 cent difference? It doesn’t cost them dramatically more to ship the gas to those gas stations,” Toews said.

“I know the Costco folks very well, and they do not sell gas at a loss. They’re making money off that meaning everybody else is making more.”

Comments